For leasing, the bank is considered best who agree on lower monthly payments because this helps the buyers to manage their monthly budgets easily. For this perspective, the Bank Alfalah car loan 2026 calculator is sufficient to get stats of markup and installment plan. In addition the requirements or required documents and eligibility of Bank Alfalah car loan is also very customer friendly. This bank offer 3 or 4 years low monthly installments if one deposit a size able down payment. In the same way if people give little down payment then they have to pay higher monthly lease payments in 5 year installments. Of course, car loan is the first choice of majority of job holders because this is only option in this budget.

Bank Alfalah Car Loan 2026 Calculator:

Financing calculator is a online tool through which it’s easy to calculate mark up that’s why Bank Alfalah car loan 2026 calculator work efficiently. Furthermore, if the people have saved up a small down payment than leasing would be the better option for these people.

- Note: Calculate the Installment of Car and plan your budget.

Markup:

In loaning for a car, the shoppers have to pay the decided first amount plus the 1st installment, security of the car which will be refunded at the time of return, down payment at the time of receiving a car, registration fee and few other charges.

- Furthermore, the markup of the Bank Alfalah Car Loan is floating between 16 Perc to 16.5 Perc. Till the financing duration of 3 years, the 16 Perc markup will apply.

- And then from 4 to 7 years duration, the markup rate is 16.5 perc that increase a bit from previous amount.

Installment Plan 2026:

With the help of car loan calculator, one will get estimation of the Bank Alfalah car installment plan 2026. The return payment tenure and the down payment are the factors that impact on the installment of car. So, it’s in your hand that which will suit you better.

- The calculator for the general installment plan is in upper Note heading and the installment for the Islamic car finance, Plan will also effect with it.

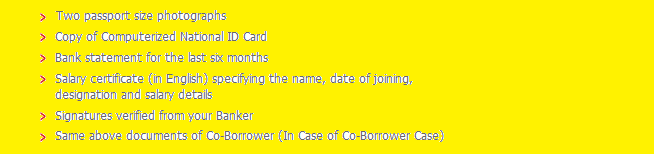

Requirements:

Yes, strictness in the requirements of Bank Alfalah car loan is not difficult to meet but if you are eligible for it. However, for a irrelative person, these are like impossible. Moreover, the Documents Required are very simple.

Usually Alfalah Bank car financing lasted for three four five (3, 4, 5) years, which basically provides the length of many warranties. This means that during the leasing tenure, the car is remained repaired or sheltered under warranty.

One more is:

- The plans and payment cycle of these banks are totally separate.

Though, people are required to maintain the condition of car which includes tire rotations, oil change and many other things. If the buyers are failed to maintain the car condition then they are charged for this at the end of the lease.

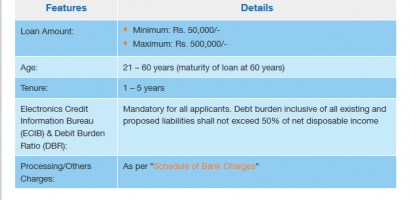

Eligibility:

Among the features of this finance policy, the major one is that one can has option to lease brand new or used car. Second major benefit is that one has option for making installments and a option is also available of large payment that is out of interest. Further, the eligibility for the car loan is:

- For this it’s necessary that one must be a citizen of Pakistan.

- Only person between 21 to 65 ages are apply for this finance policy.

- For the salary person, the mini required monthly salary amount is 30 thousand Rupees.

- While, for an businessman, the minimum return of a month is 50 thousand Rupees.

This bank announces two ways for applying for the convenience of customers. Among these procedures one is directly going to related bank and makes a plan according to requirement. Second applying procedure is in under maintenance. Through this one can easily make plan and apply for policy at home through online. Hopefully with in period of time it will in running condition.

From the installment plan to the markup and Bank Alfalah car loan 2026 calculator, the overall things are going easier. As a person, one has to pay lease for few years in installments and become owner of a car. During these years you don’t have to sell the car or received a good price for your exchange. When the leased period is finished you simply have to return the car to the dealer and walk away.