To review all aspects of Askari Bank Car Loan Calculator 2024 and policy, you can consult this source. This bank has been offering auto loan for new cars, used vehicles as well as for imported vehicles. It is on easy installment procedures that you can avail this car loan schemes. Their auto finance scheme is named as (Ask4Car). If you have a minimum income range of “25,000 Rupees” then you can apply for this scheme. Furthermore, you can use their loan calculator and then you can build a mind that how much facilitation will be given to you.

- Askari Bank Car Loan Policy

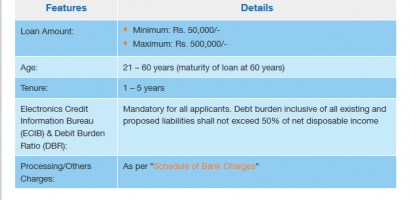

Eligibility Criteria

- This scheme is available for those vehicles which should not be older than that of 7 years.

For new vehicles, a minimum twenty (20%) equity will be required. On the imported vehicles, note that the minimum thirty (30%) of equity amount will be required. For the used vehicles, minimum amount is same as the imported ones.

- Parents or spouse and son, they can be marked as important members(co borrower). If rests of the options are not available, then brother or sister can be considered too in this category. It is mandatory and important for all applicants that they have to present their credit information to (ECIB).

Your debt burden should not exceed fifty(50%) of your gathered net disposable income. Annual mark up will be applied on this Askari Bank car loan scheme. Moreover, the markup rates is depending on many factors.

Financing Tenor for Askari Bank Car Loan Scheme

- The minimum duration is 1 year and it will enhance up to 7 years.

- For a permanent employed person, your minimum income must be (25,000 Rupees) or more. For a contractual job holder, your minimum salary has to be almost, (40,000 Rupees). Both are middle amounts.

Askari Bank Car Loan Calculator 2024:

Simple “Check” amount and this is best for Askari Bank Car Loan to collect the exact stats in 2024. So, if you have decided to finance car from them, then must take an approximate installment plan for this tool.

Required Documents for Askari Bank Car Loan Scheme

All salaried individuals should attach attested copy of their CNIC. Only, one passport size photograph and original salary slips and their attested photocopies of the last two months. You will be attaching last 6 months bank statement of yours. These are the easiest documents for those who are doing job in some registered or known company. Otherwise, thing will bit tough but possible to meet.