New figures of income tax slab rates for salaried class in Pakistan 2025-24 will provide a huge amount of money in govt fisc. Now Pakistan govt tries different tactics to improve the collection of tax. For the reason that this money is very important for progress; with the help of this amount, many projects are being completed. It is the time that we will trust the government officials. Because, it’s also a fact, that most of the population of this country has not believed on the right usage of their Tax money. So this govt also need to take steps that their country people will faith in them.

FBR Income Tax Slabs for Salaried Persons 2025-24:

It’s expected that, Income Tax Slab Rates for Salaried Class in Pakistan 2025-24 will final and normally unclose in the month of May or June. Maybe, it’s also change with expected mini budget.

Let see that it will give relief to salaried person or not. This will help and let us to smoother up the flow of our money that also effects on the economy. So need of the hour is that once a time we trust them, may this time things are going in the right direction.

- Current Approx. Tax Slab Rate:

| Salary Range | Income Tax Slab | Tax amount after specific limit |

| Till 50,000 Rupees | 0 | 0 |

| From 50 Thousand to 1 Lac Rupees | 2.5 % If total salary in a year cross 6 Lac Rupees | 0 |

| From 1 to 2 Lac Rupees | 15,000 Rupees | 12.5 % If a year salary cross 120,00,00 Rupees |

| From 2 Lac to 3 Lac Rupees | 165,000 Rupees | 20 % If total salary in a year cross 240,00,00 Rupees |

| From 3 to 5 Lac Rupees | 405,000 Rupees | 25 % If salary in year is 360,00,00 Rupees |

| From 5 to 10 Lac Rupees | 100,50,00 Rupees | 32.5 % of total salary amount |

| More than 10 Lac Rupees | 295,50,00 Rupees | 1200,00,00 Rupees |

Income Tax Slab Rates for Salaried Class in Pakistan 2025-24:

The summary of income tax slab rates for salaried class in Pakistan 2025-2024 will bring out in few months. Meanwhile, the previous tax is in the table but this amount will rise in new chart.

If authorities will be able to collect then they will able to gives proper complete facilities to the citizens. But the need is that they come up with the policies so that equal distribution of money can be ensured. If the faith of the taxpayers will be restored then the government of Pakistan will be able to carry out this process in a better way.

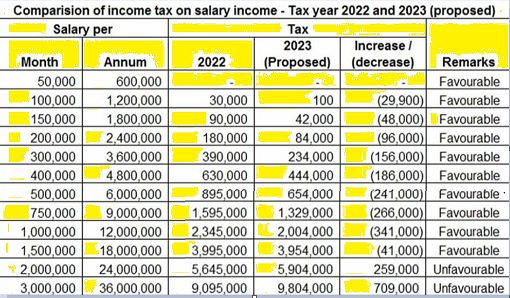

Previous and this Year Chart:

Probably, some suitable reforms should be introduced that every class gives their contribution and we need to encourage each and every citizen of Pakistan to pay. It is for their own betterment, it is for the betterment of their country as well. One should fulfill his duty in an honest way. Meanwhile, it’s also necessary that govt will revise the income tax slab rates for salaried class in Pakistan 2025-24 and decide appropriate figures.

Note: Table in below part is of Last year, but its enough for an estimation.

The way officials impose income tax slab rates for salaried class it’s necessary that they target businessmen in 2025 and 2025. The benefit will only produce when the outcome will come.

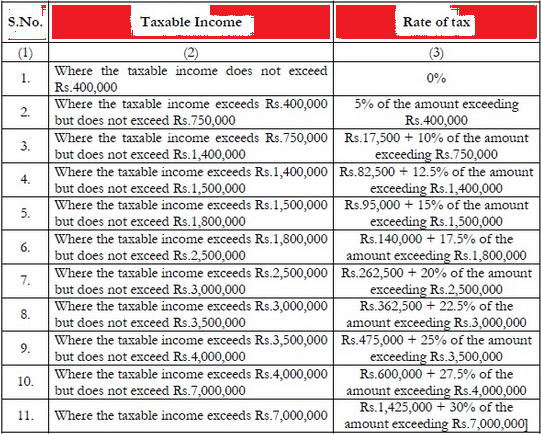

Further now on an annual base, Income Tax Rates has also in completion phase.

Last year Table:

Meanwhile, there is no doubt in this factor that corruption and one man decision make this nation hopeless. Now everyone realizes that their money is not going in the right direction so they find an alternative through which they can save it. But currently, the basic need is that everyone will trust in government, that they will utilize this money in a better way. Let see how new govt will establish a new income tax slab rates for salaried class in Pakistan 2025-24 that will balance and good for all of us.